Information Disclosure based on the TCFD Recommendations

TCFD

Information Disclosure Following the Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)

Our Group’s basic policy on sustainability is to contribute to solving social issues and to win the trust of all stakeholders involved in our business by achieving sustainable enhancement of corporate value with a corporate philosophy of “Providing the best place for people to bring out their best.”

Our Group has identified climate-related risks, considering the impact of climate change issues caused by global warming on our businesses and finances. In addition to addressing the risks already identified from a risk management perspective, we also performed a scenario analysis of climate change-related risks and possibilities in accordance with the framework proposed by the TCFD (Task Force on Climate-related Financial Disclosure). From now on, we will understand the climate change impact on our Group’s business, take necessary measures, and enhance the disclosure of related information.

Starting from the fiscal year ended December 2022, we are disclosing information on “Governance,” “Strategy,” “Risk Management,” and “Indicators and Targets,” as recommended by the TCFD. Please refer to the following information for our Group’s climate-related information based on the framework proposed by the TCFD.

i.Governance

(a) Supervision system for climate-related risks and opportunities led by the Board of Directors

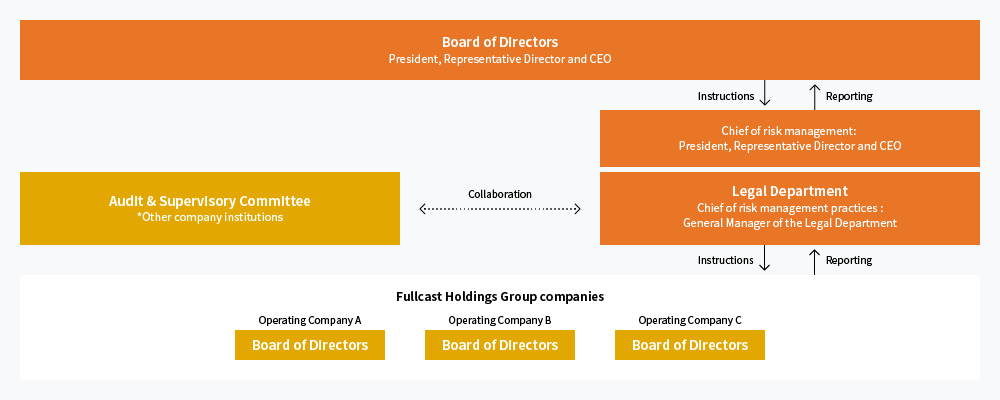

Our Group has established a system for reporting and resolving climate change related policies and important matters at the Board of Directors’ Meetings, in order to strengthen and promote the sustainability of its business operations.

Under the “Fullcast Group Sustainability Basic Policy,” the Board of Directors receives reports on climate change and supervises actions.

Our Group does not have a committee dedicated to climate change; instead, there is a system in place to report on these matters in a timely manner whereby the Legal Department takes the lead in identifying and discussing sustainability issues, including climate change, covering the entire Group. Additionally, in order to appropriately manage risks in our Group’s organizations, the President, Representative Director and CEO serves as the chief of risk management and the General Manager of the Legal Department serves as the chief of risk management practices. The General Manager of the Legal Department, following the instructions of the President, Representative Director and CEO, works with our Company’s institutions including the Audit & Supervisory Committee to assist in the execution of duties of the President, Representative Director and CEO.

(b) Role of executive management in evaluating and managing climate-related risks and opportunities

The President, Representative Director and CEO serves as the chief officer for our Group’s sustainability management. He/She manages climate-related risks and opportunities holistically and is the ultimate person in charge of management decisions related to environmental issues.

ii.Strategy

(a) Assumptions of strategy

Our Group evaluated the potential occurrence and financial impacts of risks and opportunities by the fiscal year ending December 31, 2030 based on multiple climate change scenarios, and confirms countermeasures for mitigation of main risks and seizing opportunities at the Board of Directors’ Meetings. Additionally, during scenario analysis, our Group referred to reports, of the International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC), and identified the impacts on business, strategy and financial plan of the organization caused by climate change risks and opportunities under the 4°C and 1.5–2°C scenarios. The specific scenarios referenced are as follows.

・4°C scenario*1

IEA’s “Stated Policies Scenario”

IPCC RCP 8.5

・1.5–2°C scenario*2

IEA’s “Sustainable Development Scenario”

IEA’s “Net Zero Emissions Scenario”

IPCC RCP 2.6

*1 4°C scenario: 3.2–5.4°C higher than Industrial Revolution levels if no additional measures against global warming are taken. Progress is not made with the policies/legislation on climate change countermeasures or the transition to a decarbonized society, and physical risks of climate change emerge.

*2 1.5–2°C scenario: 0.9–2.3°C higher than pre-Industrial Revolution levels if strict measures are taken. Policies/legislation on climate change countermeasures are significantly strengthened, causing social changes toward decarbonization, and transition risks of climate change emerge.

(b) Main risks and opportunities associated with climate change

In identifying climate change-risks and opportunities, risks are largely categorized into transition risks and physical risks, and further classified into policy and legal risks, reputational risks, acute risks and chronic risks, while opportunities are categorized according to energy source, products/services, and resilience. Our Company predicted and analyzed the impacts on its business activities and revenue for each of these classifications. The potential occurrence and financial impacts of the main risks identified through scenario analysis for our Group are as follows.

<Main risks associated with climate change>

| Large classification |

Middle classification |

Small classification |

Financial impact | Countermeasures and initiatives | |

|---|---|---|---|---|---|

| 4°C | 2°C | ||||

|

Transition Risk |

Policy and Legal Risk |

|

- | Low | Reduce GHG emissions by continuously implementing energy-saving countermeasures |

|

Reputation Risk |

|

Med. | Med. | Set carbon neutrality target Disclose climate change related initiatives appropriately Implement initiatives to reduce GHG emissions |

|

|

Physical Risk |

Acute Risk |

|

Low | Low | Continuously review BCP plan Enhance ability to manage human resources taking labor environment into account |

| Chronic Risk |

|

Low | Low | ||

Through this analysis, in terms of transition risks, our Company recognized reputational risk related to reputational damage caused by delay in climate change related initiatives or violations of laws and regulations, and changes in reputation among stakeholders such as client companies, employees and investors. Going forward, our Company will establish a carbon neutrality target for our Group, disclose climate change related initiatives appropriately, and deepen reviews of initiatives for reducing our Group’s greenhouse gas emissions, and will work to mitigate impacts involving these risks. In terms of physical risks, by establishing a business continuity plan (BCP) and reviewing it as necessary, our Company has prepared to ensure the continuity or early restoration of its important business operations during a contingency. Therefore, our Company did not identify major physical risks that will impact our Group’s business strategy. Going forward, our Company will focus on how climate change impacts our Group as well as continuously review its assessments and further enhance its information disclosures.

Additionally, the potential occurrence and financial impacts of the main opportunities identified through scenario analysis for our Group are as follows.

<Main opportunities associated with climate change>

| Large classification |

Middle classification |

Small classification |

Financial impact | Countermeasures and initiatives | |

|---|---|---|---|---|---|

| 4°C | 2°C | ||||

| Opportunity | Energy Source |

|

Low | Low | Use energy sources and services with low cost and low environmental impact (promote sales offices to adopt EVs as sales vehicles) |

|

Products and Services |

|

Low | Low | Expand clients using short-term staffing services and BPO services, including environmental related domains, or increase revenue by capturing staffing needs Increase revenue by entering new business domains through establishment of new subsidiaries or M&A |

|

| Resilience |

|

Low | Low | Continuously review BCP plan Continuously implement energy-saving countermeasures |

|

Through this analysis, our Company confirmed that promoting further business growth centered around the Short-Term Operational Support Business, a medium- to long-term management strategy of our Group, will enable it to seize climate change opportunities. Going forward, our Group will carefully monitor trends in society and among stakeholders in terms of climate change and identify changes so as to seize climate change opportunities.

iii.Risk Management

(a) Identification and assessment process of climate-related risks

Our Group, following the framework proposed by the TCFD, predicted changes in the external environment using scenario analysis methodology, and analyzed the climate change risks and opportunities that will impact its business operations. As an initiative in the first fiscal year of this program, in the fiscal year ended December 31, 2022, our Company narrowed its analysis to the Group’s Short-Term Operational Support Business, which has the largest impact.

Climate-related risks and opportunities are identified and assessed at the Group’s Board of Directors’ Meetings. First, the Legal Department will collect information from each department in an effort to identify the current situation of climate-related risks and opportunities. The Board of Directors will identify risks and opportunities in the 4°C and 1.5–2°C scenarios based on the information compiled by the Legal Department. In assessing these risks and opportunities, our Company will analyze the financial impacts that the identified risks and opportunities will have on our Group’s business activities and earnings, and assess these impacts. Based on these assessment results, the Board of Directors discusses and determines action plans containing targets and specific measures for mitigating risks and maximizing opportunities. The matters discussed and determined by the Board of Directors will be conveyed to each department via the Legal Department, where they will be put into practice.

(b) Management process of climate-related risks and situation of integrating with the Group’s management risks

Our Group defines basic matters concerning its risk management system under its “Basic Risk Management Regulations,” and integrates operations for efficient and reliable risk management, including climate change-related risks, within its risk management system.

The General Manager of the Legal Department is the chief of risk management practices. The General Manager of the Legal Department, following the instructions of the President, Representative Director and CEO, who also serves as the chief of risk management, works with the Company’s institutions including the Audit & Supervisory Committee to assist the execution of duties of the President, Representative Director and CEO.

Additionally, the President, Representative Director and CEO regularly reports to the Board of Directors on the development of initiatives and operational processes for the risk management system, and immediately reports to the Board of Directors in case of a serious event.

iv.Indicators and Targets

(a) GHG emissions

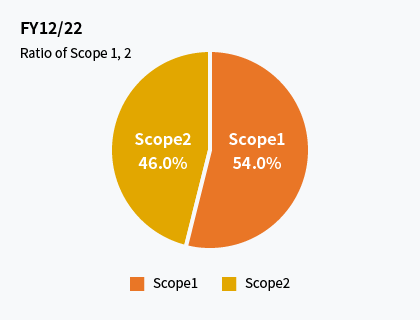

Our Group selects GHG emissions (Scope 1, 2) as indicators for measuring and managing climate related risks and opportunities. GHG emissions are calculated following the GHG Protocol. Our Group’s Scope 1 and Scope 2 GHG emissions for the fiscal years ended December 31, 2021 and 2022 were as follows.

<GHG emissions within our Group (Scope 1, 2)>

| Item | Unit | Results | ||

|---|---|---|---|---|

| FY12/21 | FY12/22 | |||

|

Greenhouse gas emissions (Scope 1, 2) |

Total | t-CO2 | 2,397 | 2,428 |

| Scope1 | t-CO2 | 1,359 | 1,311 | |

| Scope2 | t-CO2 | 1,038 | 1,117 | |

|

CO2 emissions intensity (Scope 1, 2) |

Total |

t-CO2/ million yen |

0.05 | 0.04 |

Note: Figures are tabulated for the entire Group (excluding equity method affiliates).

Furthermore, Scope 3 emissions were not calculated. We will explore the calculation and disclosure of these emissions in the future.

<Comparison of greenhouse gases (Scope 1, 2)>

(b) GHG reduction target

Our Group is considering its target for GHG reduction. Going forward, our Group will develop a roadmap for achieving carbon neutrality and expand upon its reviews regarding the formulation and disclosure of targets.

(c) Initiatives to reduce GHG emissions and conserve energy

GHG emissions in our Group’s industrial domain are rather small compared to other industries. Additionally, given its business characteristics, our Group has not identified serious risks related to climate change that could directly impact its business activities or revenue. Furthermore, our Group’s Scope 1 and Scope 2 GHG emissions are believed to be relatively small. Nevertheless, there are risks associated with the introduction of tax systems or stricter regulatory requirements in the future. Therefore, our Group will work to the extent possible to reduce its GHG emissions. In calculating these emissions, our Group will use a similar methodology in an effort to obtain objective data.

Our Group is committed to reducing environmental impacts and using resources efficiently wherever possible to contribute to solutions to climate change issues. As initiatives for reducing CO2 and promoting energy savings within our Group, we are exploring the utilization of low cost energy sources and services with a low environmental impact, such as promoting paperless operations (digitization), reducing paper usage, recycling used paper, recommending a business casual dress code, promoting telework, and switching sales vehicles at our sales offices to EVs.